Describe the Difference Between Using a Plantwide Factory Overhead Rate

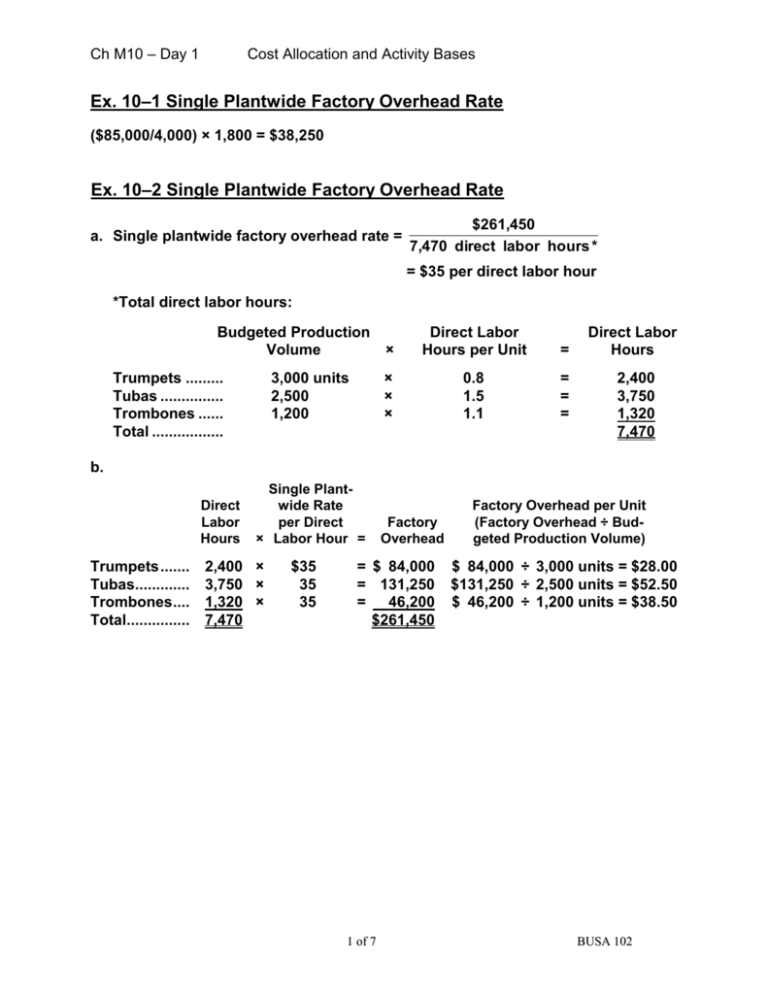

The department allocation A method of allocating costs that uses a separate cost pool and therefore a separate predetermined overhead rate for each department. Business Accounting QA Library Single plantwide factory overhead rate Bach Instruments Inc.

Departmental Vs Plantwide Overhead Rate Demonstration Problem Youtube

Is simpler and less expensive to compute than a plantwide rate c.

. Simple to apply but can lead to product cost distortions. Results in more accurate product costs b. Assume that it is customary in the industry to bid jobs at 150 of total manufacturing cost direct materials direct labor and applied overhead.

B Determine the amount of manufacturing overhead cost that that would have been applied to the Hastings job. Calculate the manufacturing overhead cost of the A Frame using. Product A requires 15 hours per unit so the overhead rate is 15 times 48 or 72 per unit.

The plantwide overhead rate charges an equal share of the total overhead to each product created in that plant. Makes three musical instruments. Using multiple department factory overhead instead of a single plantwide factory overhead rate.

Predetermined plantwide rate 180 00045 000 4 per labour hours. Explain the difference between the manufacturing overhead that would have been applied to the Hastings job using the plantwide rate in question 1b and using the departmental rates in question 2b. Assuming the use of a plantwide overheard rate.

The departmental rate is different. A single plant wide factory overhead rate can be used to. 7 hours X 50 1 hours X 20 350 20 370.

However if departmental manufacturing overhead rates are used the amount assigned to Product A will be. Results in distorted product costs. Using a plantwide factory overhead rate distorts product costs when.

Based on this information the companys plant-wide overhead rate will be 40 per machine hour. A Compute the rate for the current year. Suppose that instead of using a plantwide overhead rate the company had used a separate predetermined overhead rate in each department.

Either A or B exist. Significant differences exist in the factory overhead rates used across different production departments cboth A and B are true d. According to a survey 34 of the manufacturing businesses use a single plant wide overhead rate 44 use multiple overhead rates and rest of the companies use activity.

Though use of departmental overhead absorption rate is considered better than using a single factory wide overhead absorption rate but it has certain pros and cons which are given below. The use of multiple predetermined overhead rates may be a complex and time consuming task but is considered a more accurate approach than applying only a single plant-wide rate. Manufacturing overhead 540000 800000 100000 1440000.

First step is to calculate the Total budgeted plantwide allocation base for sheer curtains and. Allocate all plant overhead to all products. Explain the difference between the manufacturing overhead that would have been applied to the Hastings job using the plantwide rate in question 1b and using the departmental rates in question 2b4.

The products have the following budgeted production volume and direct labor hours per unit. The company produces similar products and it expects to use 20000 machine hours. Using a plant-wide factory overhead rate distorts product costs when.

Amount of cost allocated 45 b a predetermined plantwide rate based on machine hours. Jobs require varying amounts of work in the three departments. Products require different ratios of allocation-base usage in each production department B.

Significant differences exist in the factory overhead rates used across different production departments C. Approach is similar to the plantwide approach except that cost pools are formed for each department rather than for the entire plant and a separate predetermined overhead rate is established for each. If products y and z were the ONLY two products produced in this plant they both would be charged 50 of the total overhead.

A a predetermined plantwide rate based on direct labour hours. The budgeted factory overhead cost is 106500. Using the plant-wide rate of 30 the manufacturing overhead costs assigned to Product A would be 240 8 total hours X 30.

The companys high-volume products are overcosted and its low-volume products are undercosted. Explain the difference between the manufacturing overhead that would have been applied to the Koopers job using the plantwide approach in question 1 b and using the departmental. Flutes clarinets and oboes.

Divided into the overhead of 120000 this comes to 48 in overhead per labor hour. Direct labor 300000 200000 400000 900000. The overhead expense rate for every department in a factory production process.

Predetermined 180 000120 000 1 per machine hours. Calculation for What would the factory overhead allocated per unit for insulated curtains using the single plantwide factory overhead rate be. Determine the amount of manufacturing overhead cost that would have been applied to the Hastings job.

I Use of separate rates for different departments facilities better control as the departmental managers being responsible for costs of their respective departments have a. Products require different ratios of allocation-base usage in each production department b. Neither A nor B are true.

Assume a company uses a plantwide predetermined manufacturing overhead rate that is calculated using direct labor hours as the cost driver. The use of this plantwide predetermined manufacturing overhead rate has resulted in cost distortion. Applies overhead costs to all departments equally d.

For product B two labor hours are needed per unit so. Suppose that instead of using a plantwide predetermined overhead rate the company had used departmental predetermined overhead rates based on direct labor cost. There are significant differences in the factory overhead rates across different production departments B The products require different ratios of allocation base usage in each.

Budgeted plantwide allocation base for sheer curtains45000 dlh. Both A and B exist D. If each product requires 15 minutes of machine time each products cost will include 10 of manufacturing overhead 15 minutes 14 hour X 40 per machine hour.

Overhead is allocated to the three products on the basis of direct labor hours. The Hastings job for example would have required manufacturing costs in the three departments as follows.

Solved What Is The Difference Between The Following Methods Chegg Com

No comments for "Describe the Difference Between Using a Plantwide Factory Overhead Rate"

Post a Comment